Process Description Outbound Germany

Introduction

On 22 March 2024, the German Bundesrat approved the Growth Opportunities Act. This legislation introduces mandatory e-invoicing for transactions between taxable persons established in Germany (B2B transactions). The e-invoicing obligation will be the first step to the introduction of an e-reporting system. According to the approved legislation, taxpayers will need to issue and receive structured electronic invoices for transactions in scope of the mandate. E-invoices will in principle need to comply with the European e-invoicing standard CEN 16931 (which means that the existing XRechnung and ZUGFeRD formats should generally be acceptable).

Specific rules are foreseen for EDI procedures, which will remain possible under conditions (e.g. extraction into EN16931). In the envisioned model, the transmission of the structured e-invoice between taxable persons will not be regulated, meaning that there would be no requirement to send e-invoices to the tax authorities for verification/clearance of the e-invoice before issuance. Some transactions will be excluded from the e-invoicing obligation such as simplified invoices (max. EUR 250), VAT exempt transactions without the right to deduct input VAT, passenger transportation tickets and B2C sales. Germany has received approval from the Council of the European Union to mandate B2B e-invoicing. The decision takes effect from 1 January 2025 to 31 December 2027 (or until the moment ViDA is adopted).

https://www.recht.bund.de/bgbl/1/2024/108/VO

January 2025: taxpayers must be able to receive e-invoices from their suppliers. Paper invoices can only be used with the consent of the invoice recipient. During 2025 and 2026, both the e-invoices and paper invoices will be valid.

January 2027: taxpayers with an annual turnover exceeding EUR 800,000 will have to issue e-invoices.

January 2028: all German taxpayers will have to issue e-invoices.

Legal information

Retarus strongly recommends consulting a local tax advisor regarding tax law issues. The information provided here is not guaranteed.

Outbound invoices

The outbound transfer of invoices is divided into several steps, which are described below.

Step 1 – Creation and transmission

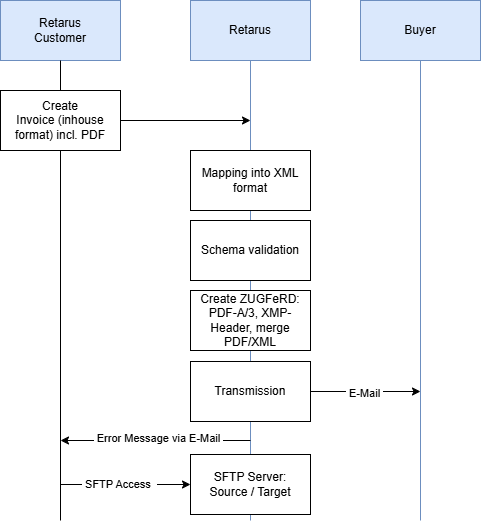

The Retarus customer creates an electronic invoice in their ERP system and sends it to Retarus in an internal (and documented) format (source format). Attachments can be transmitted if this is documented (Base64 encoded). An embedded PDF is required, if Retarus shall create ZUGFeRD documents. The transmission protocol can be selected from a variety of existing standard protocols (such as tRFC, AS2 or SFTP).

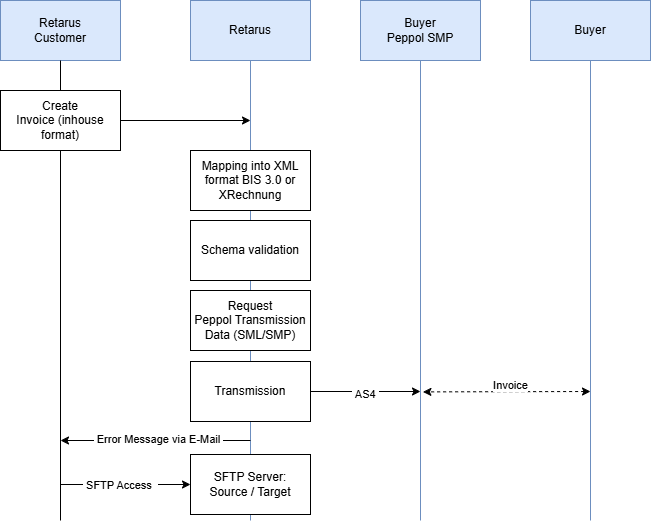

Step 2 – Data processing and Peppol transmission

Retarus converts the source format into the desired XML target format. Customers can choose between the following standards:

CII (EN-16931)

XRechnung (CII)

ZUGFeRD (EN-16931 Profile) – embedded PDF required

The resulting XML document is validated in a further step. The currently valid Schematron is used for this purpose. If the check fails, the invoice is not sent. A verification report is created and sent to the customer by email.

If the customer has selected the “ZUGFeRD” format and the XML validation was successful, the originally embedded PDF file is first converted to PDF-A/3 format. The so-called XMP header data according to the ZUGFeRD standard is then written into the PDF file. The XMP header contains the version used and the profile name of the ZUGFeRD document. Finally, the PDF and XML documents are merged.

In the next step, the document is sent to the recipient via email.

Step 3 – Archiving process

Once Retarus has successfully transferred an invoice, it transfers the source and target documents to a Retarus SFTP server. The customer is given access to this server and can retrieve these documents for further processing within 30 days before they are automatically deleted.

Options

Peppol

Peppol is an EDI network that allows any number of network participants to send documents to the recipient via a so-called Peppol ID. Peppol can be set up either instead of the e-mail inbox or in addition to e-mail. Only XRechnung or Peppol BIS 3.0 invoices in UBL or CII data format can be transmitted via Peppol. It is not possible to send or receive other data (including ZUGFeRD) in the Peppol network, which means that this channel can be considered to be single-purpose compared to email.

Retarus converts the source format into the required XML target format. The customer must choose between XRechnung or Peppol BIS 3.0. The resulting XML document is validated in a further step. The currently valid Schematron from Peppol is used for this purpose. If the check fails, the invoice is not sent. A verification report is generated and sent to the customer via email. If the verification is successful, the recipient's Peppol parameters are queried from the SML (central Peppol address book) and then from the recipient's Peppol provider (SMP service) and subsequently transmitted. If the SMP service and/or the recipient's receiving service cannot be reached, another attempt is made to deliver the invoice within a limited period of time. If this is unsuccessful, an error message is sent by email to the customer, who must resend the invoice at a later date.