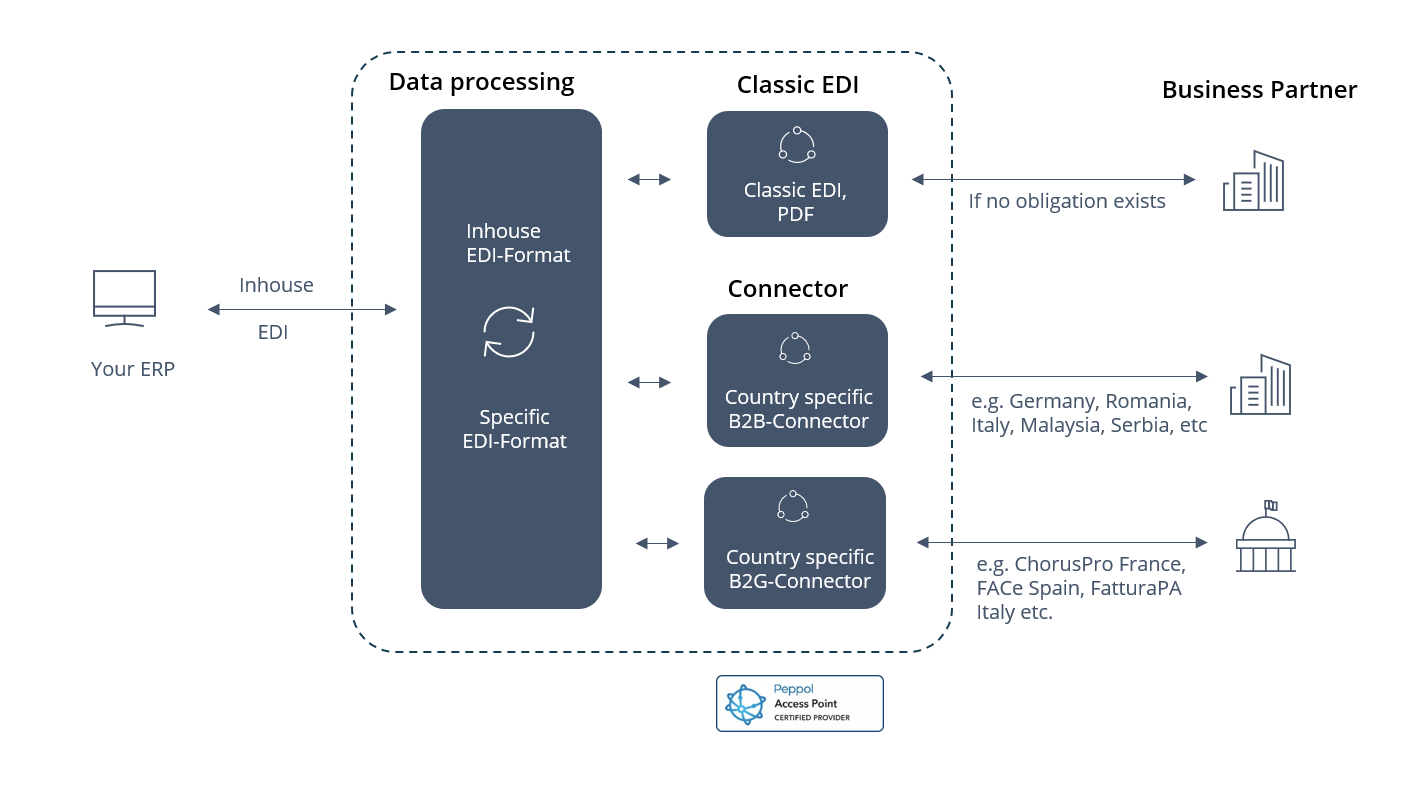

E-Invoicing Description

Retarus E-Invoicing facilitates the legally compliant sending and receiving of digital invoices for B2B, B2C, and B2G interactions. It supports fast integration into ERP systems via EDI and APIs, and offers scalability and connection to international networks, including PEPPOL access points.

System Architecture

Key Features

Regulatory Compliance

Retarus e-Invoicing ensures that all documents comply with country-specific regulations and standards, including the EU Directive 2014/55/EU, UBL, Factur-X (ZUGFeRD).

Comprehensive coverage

Ensures that invoicing processes meet the regulations of more than 65 countries, including future-proof compliance with B2G and B2B standards.Certifications

Includes PEPPOL access and compliance with GDPR, HIPAA, and other international standards, ensuring secure and legally compliant invoicing.Global compliance

Meets country-specific e-invoicing regulations.IT integration

Integration into ERP system via EDI and APIs.Tax authority integration

Streamlined submission to official government portals.Automated validation

Pre-checks for errors before submission, minimizing rejections.Data centers

Uses its own European data centers with high security standards and business continuity options.Long-term archiving

Provides legally compliant archiving, enabling secure storage and easy retrieval of invoices, according to GoBD guidelines.Invoice data checks

Offers optional validation checks for invoice data, such as IBAN verification, to ensure data accuracy before forwarding.Automatic data capture

Invoice data can be automatically captured with IDR technology

Security

All data transmitted and stored is encrypted to ensure that sensitive information remains protected. With ISO 27001-certified data centers and full GDPR compliance, business communications remain secure and meet all data privacy requirements.

Certified data centers

ISO 27001 certification guarantees the highest security standards.End-to-end encryption

Ensures secure data transmission and storage.GDPR compliance

Adherence to stringent data protection laws, European headquarters.

Cloud EDI Integration

By supporting a wide range of industry-standard EDI formats such as EDIFACT, ANSI X12, and XML, the service can adapt to any business partner’s requirements, ensuring smooth communication.

Format flexibility

Support for multiple EDI formats.Dynamic document routing

Tailored routing of business documents to partners.Real-time monitoring

Detailed dashboards for tracking and managing document flows.ERP integration

Seamlessly integrates with ERP systems via EDI, reducing setup time and effort. Supports major ERP systems used by multinational companies, ensuring wide applicability.Cloud-based architecture

Minimizes the need for extensive IT resources.Multiple channels

Enables sending and receiving invoices through EDI, API, email (PDF), and fax, providing flexibility in communication methods.Hybrid formats

Supports hybrid invoicing formats, such as ZUGFeRD 2.X, which combines structured data and human-readable invoices in a single PDF file, ensuring compliance with various regional standards.eSign integration

Invoices are issued with a qualified electronic signature, ensuring compliance with external and internal e-Invoicing requirements.

Dashboard and Reporting

Track invoice processing with ease. Get an overview, seamless archiving, and instant access to your documents, all in one place.

Overview and monitoring

The status of all processed invoices from the last 90 days can be tracked in our Enterprise Administration Service (EAS) portal.Transparent reporting

All documents are automatically transferred to the archive system operated by a Retarus partner after successful transmission. All files can be easily displayed and searched within the web portal of the long-term archive system.

Scalability

One of the key strengths of the Retarus solution is its scalability. Whether you are processing a few thousand or millions of transactions, the service adapts to your needs, allowing for flexible growth without compromising performance.

Global scalability and speed

Handles large volumes of transactions across multiple regions. Accelerates the creation, processing, sending, and receiving of invoices, leading to quicker transaction times and improved cash flow.Customizable workflows

Offers flexible workflows to meet specific business needs.

Implementation and Support

Each business has unique requirements for document exchange, which is why the implementation process is fully customized. From initial setup to integration with existing systems, Retarus provides a comprehensive implementation service. A dedicated support team is available 24/7 to assist with technical issues, ensuring seamless operation at all times.

Implementation process

Quick and easy integration, supports all major international formats. Full integration and customization support.Ongoing support

24/7 expert support team to assist with any challenges.