A detailed look into your Email Security invoice

At Retarus, we value transparency. When you receive an invoice from us, you should never be unsure about who you’re paying or what you’re paying for. This page walks you through your invoice step by step, so you can easily read and understand each section.

📌 Sample invoice

You can download a sample invoice as a PDF to see the complete layout.

Download sample invoice (PDF)

Name and address of your company

This section shows your company's billing address, which we use to determine your applicable taxes and ensure the invoice reaches the right recipient.

Reference details

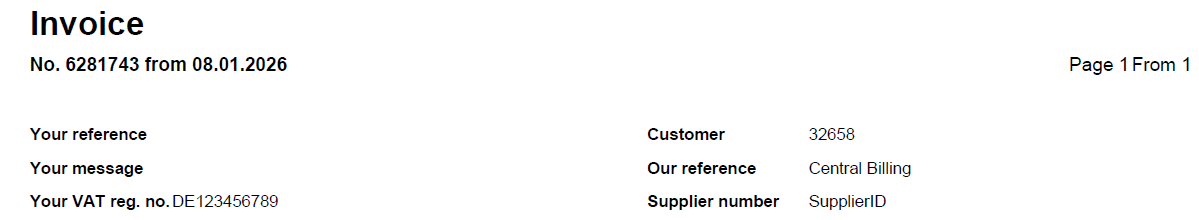

This section gives you all key information at a glance:

Your unique invoice identifier and the date it was issued.

Shows which page you're viewing and the total number of pages.

Your internal reference information (if provided).

Any message or note you've shared with us.

Your company's VAT registration number.

Your unique Retarus customer identifier.

The Retarus department handling your account.

Our supplier number for your records (if applicable).

Purchase order number

Itemized cost breakdown

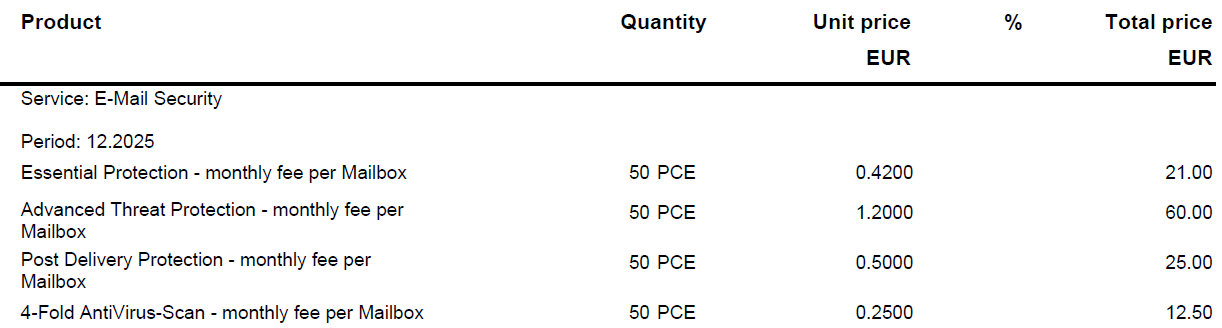

This is the centerpiece of your invoice. It breaks down all your charges by product and usage, showing:

The Retarus product you're using - that is,

Email Security.The month covered by the charges (e.g.,

12.2025).Detailed line items for each Email Security feature.

Number of mailboxes protected.

Monthly fee per mailbox.

Any applicable accounts.

The calculated cost for each line item.

This gives you maximum transparency and insight into your product usage and the associated charges.

Tax details and sum total

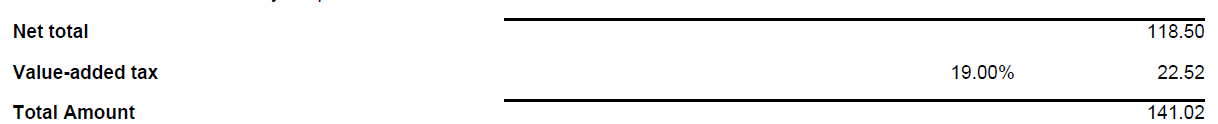

This section shows:

Net total

The sum of all charges before tax.Value-added tax

The applicable VAT rate (e.g., 19.00%) and the calculated tax amount. The VAT calculation is based on your company address and the applicable tax regulations in your region.Total Amount

Your final invoice amount including all taxes.

Payment terms

This section provides all the information you need to pay your bill:

Payment terms (e.g., "14 Days net").

Due date by which payment must be received.

The total amount to be paid.

Final remarks

We hope this helps you better understand your invoice and gives you the insights into your usage, charges, and payment terms that you need. If you have any further questions, please do not hesitate to contact your customer care representative.