A detailed look into your Cloud Fax invoice

At Retarus, we value transparency. When you receive an invoice from us, you should never be unsure about who you’re paying or what you’re paying for. This page walks you through your invoice step by step, so you can easily read and understand each section.

📌 Sample invoice

You can download a sample invoice as a PDF to see the complete layout.

Download sample invoice (PDF)

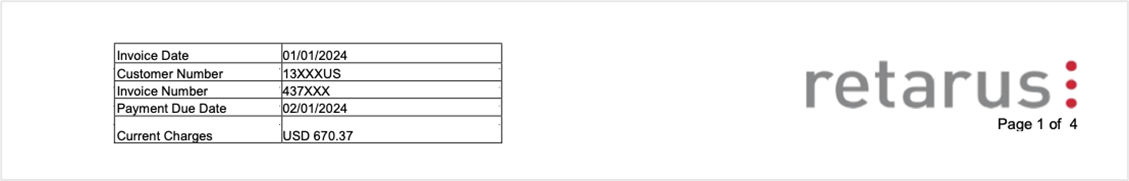

Executive summary

This first section of your invoice gives you all key information at a glance:

invoice date

due date

your customer and invoice numbers

your current charges

total number of pages

You’ll find this section repeated on every page of your invoice.

Name and address of your company

This is the address we use to determine your applicable taxes.

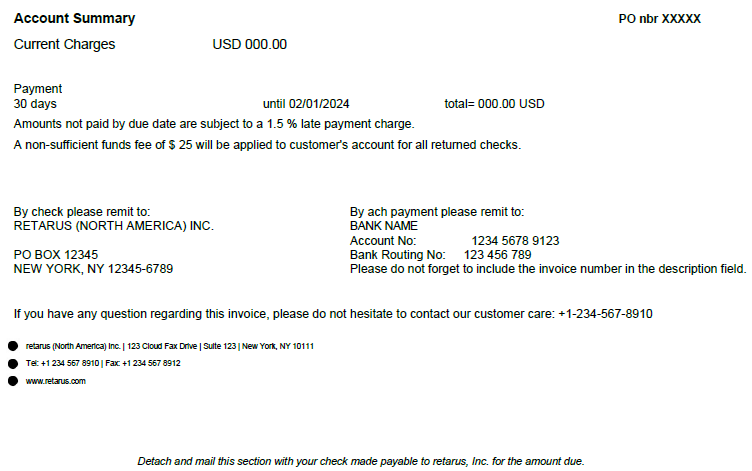

Account summary

This section summarizes everything you need to know to pay your bill, including:

the amount owed

payment terms

our address for mailed checks

our bank details for ACH payments

It also includes the contact information of our customer care team, in case you have any questions about your invoice.

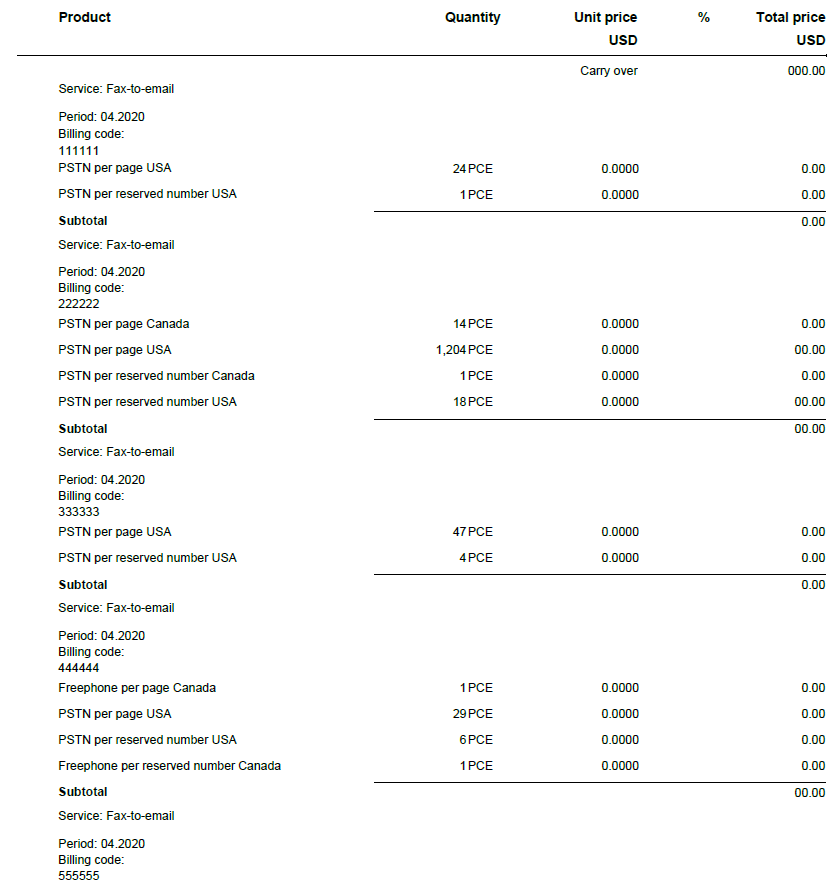

Itemized cost breakdown

This is the centerpiece of your invoice. It breaks down all your charges by product and usage. If you’re using billing codes (which we highly recommend for internal cost allocation), your charges are broken down by those as well. This gives you maximum transparency and insight into your product usage and the associated charges.

Tax details

This section sums up the net total of your invoice and breaks down the taxes charged by tax type. The calculation is based on your company address.

Sum total and wrap-up

The end of your invoice summarizes all costs and once again provides all the information you need in case you have any questions about your invoice or the payment process.

Final remarks

We hope this helps you better understand your invoice and gives you the insights into your usage, charges, and payment terms that you need. If you have any further questions, please do not hesitate to contact your customer care representative.